TD Bank Confirms Data Breach: How Xcitium’s Zero Trust Approach Protects Against Financial Cyberattacks

Updated on February 3, 2025, by Xcitium

TD Bank has confirmed a data breach exposing customer account numbers and other sensitive information, adding to the growing list of financial institutions targeted by cybercriminals. This breach underscores the vulnerabilities that persist in the banking sector and the need for proactive cybersecurity measures.

As financial institutions face increasingly sophisticated cyber threats, relying on outdated security models that assume safety until proven otherwise is no longer an option. Xcitium’s Zero Trust approach ensures that every file, application, or executable is verified—never assuming it is safe just because it hasn’t been flagged as dangerous. This proactive security model can prevent breaches like the one TD Bank is now dealing with.

Why Financial Institutions Are Prime Targets for Cyberattacks

Banks and financial organizations are among the most attractive targets for cybercriminals due to:

1. High-Value Data

Banks store sensitive financial information, including account numbers, Social Security numbers, and payment credentials.

2. Widespread Digital Access

Online banking, mobile applications, and third-party integrations create multiple entry points for attackers.

3. Legacy IT Infrastructure

Large banks rely on legacy systems and extensive third-party vendors, increasing security risks.

4. Lucrative Ransom and Fraud Opportunities

Attackers can steal money directly from accounts or sell stolen data on the dark web for fraud and identity theft.

The Impact of the TD Bank Breach

The consequences of this breach extend beyond TD Bank itself, affecting millions of customers and the broader financial sector:

- Compromised Customer Trust: Exposing personal and financial data damages confidence in TD Bank’s security practices.

- Increased Fraud and Identity Theft: Cybercriminals can use leaked data to commit financial fraud, file fraudulent tax returns, or sell information to other attackers.

- Regulatory and Legal Repercussions: Data breaches in the financial sector often lead to lawsuits, fines, and compliance violations under GDPR, CCPA, and PCI-DSS regulations.

- Financial and Reputational Damage: Breaches lead to lawsuits, lost customers, and diminished market reputation.

The Flaws in Traditional Cybersecurity Approaches

Despite the evolving threat landscape, many financial institutions still rely on reactive cybersecurity measures that detect threats only after they have already executed. Common security gaps include:

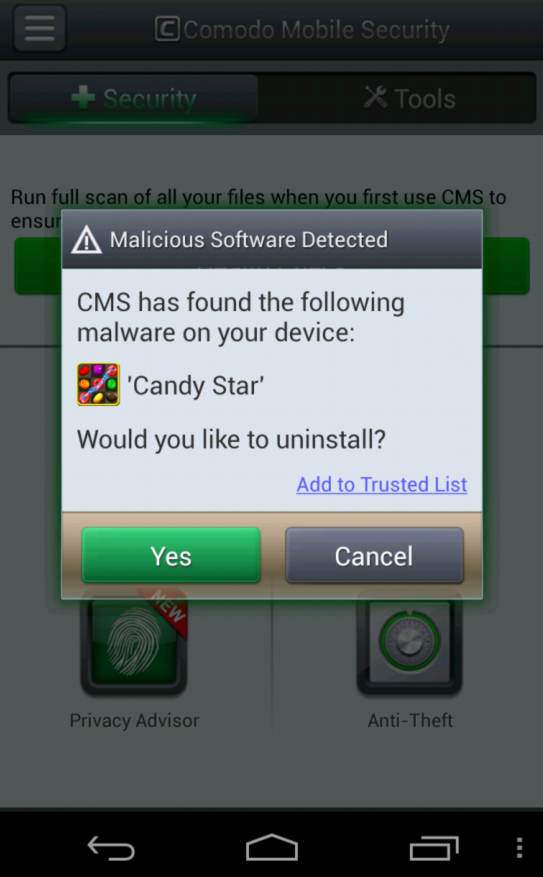

1. Assuming Safety Until a Threat is Detected

Many banks rely on threat detection tools that only react when a known threat is identified, leaving systems vulnerable to new or unknown attacks.

2. Lack of Proactive Threat Containment

Malware, ransomware, and exploits can spread rapidly before traditional security tools respond, causing significant damage.

3. Over-Reliance on Authentication-Based Zero Trust

While many banks use identity verification and multi-factor authentication (MFA), this does not stop malicious files, scripts, or applications from executing inside a network.

Xcitium’s Zero Trust Approach: The Key to Stopping Financial Data Breaches

Xcitium’s Zero Trust architecture takes a fundamentally different approach, ensuring that every file, application, or executable is assessed and diagnosed for risk—never assuming something is safe just because it hasn’t been flagged as dangerous.

How Xcitium’s Zero Trust Approach Works:

1. No Assumptions About Safety

Every file, executable, and application is analyzed. If its safety is unknown, it is automatically placed into ZeroDwell technology for safe, virtualized execution until verified.

2. ZeroDwell Technology

Xcitium proactively neutralizes potentially malicious files in real time by virtualizing their attack vectors, preventing ransomware, malware, and exploits from executing inside financial networks.

3. Proactive Threat Prevention

Unlike traditional detection-based security tools, Xcitium prevents threats before they can cause damage, ensuring that financial institutions are never caught off guard.

4. Scalable Security for Large Financial Networks

Designed to secure banks, fintech firms, and financial service providers, Xcitium’s solutions provide real-time protection across cloud, on-premises, and hybrid environments.

Steps Financial Institutions Can Take to Prevent Data Breaches

The TD Bank breach is a reminder that financial institutions must evolve their cybersecurity strategies. Key actions include:

1. Adopt a Proactive Zero Trust Model

Ensure that every file, executable, and application is verified before being allowed to interact with banking systems.

2. Deploy Real-Time Threat Containment

Prevent malware and ransomware from executing by using ZeroDwell technology that proactively neutralizes threats without disrupting business operations.

3. Enhance Third-Party and Supply Chain Security

Many financial breaches originate from vulnerabilities in third-party vendors or partners. Organizations must ensure strict security protocols across all integrations.

4. Conduct Continuous Risk Assessments

Regular security audits and real-time monitoring help detect and address vulnerabilities before cybercriminals can exploit them.

5. Invest in AI-Powered Threat Intelligence

Advanced AI-driven threat analysis and behavioral monitoring provide early detection and prevention of cyber threats.

How Xcitium Protects Financial Institutions Like TD Bank

Xcitium’s enterprise-grade security solutions stop cyber threats before they cause financial and reputational damage.

Key Features of Xcitium’s Security Platform:

- ZeroDwell Technology: Instantly neutralizes unknown threats by virtualizing their attack vectors.

- Proactive Threat Validation: Ensures that all files, applications, and executables are verified for safety.

- Enterprise-Grade Scalability: Protects banks, payment processors, and fintech firms across global networks.

- Regulatory Compliance Support: Helps financial institutions comply with GDPR, PCI-DSS, CCPA, and other data protection laws.

- AI-Driven Threat Intelligence: Provides real-time insights into emerging cyber threats and vulnerabilities.

Conclusion: Preventing the Next Financial Sector Data Breach

The TD Bank data breach is a costly reminder that financial institutions must rethink their cybersecurity strategies. In today’s rapidly evolving cyber threat landscape, legacy detection-based security is not enough—organizations need a proactive Zero Trust model that validates every file and executable before it can cause harm.

Xcitium’s ZeroDwell technology and proactive threat validation give financial institutions the tools to prevent breaches before they happen, safeguarding customer trust, protecting sensitive financial data, and ensuring compliance with regulatory requirements.

In cybersecurity, prevention is the best defense. With Xcitium, financial institutions don’t just detect threats—they stop them before they start.