$129 Million in Cryptocurrency Losses in October: The Urgent Need for Stronger Cybersecurity in the Digital Asset Space

Updated on November 13, 2024, by Xcitium

In October alone, cryptocurrency investors suffered a staggering $129 million in losses due to hacks and exit scams. These alarming figures underscore the growing security challenges facing the digital asset industry. As cryptocurrency adoption continues to rise, so do the risks associated with storing, trading, and transacting in digital currencies. This latest wave of attacks is a wake-up call for exchanges, wallet providers, and investors to adopt more robust cybersecurity measures to protect against increasingly sophisticated threats.

The Nature of the Threats: Hacks and Exit Scams

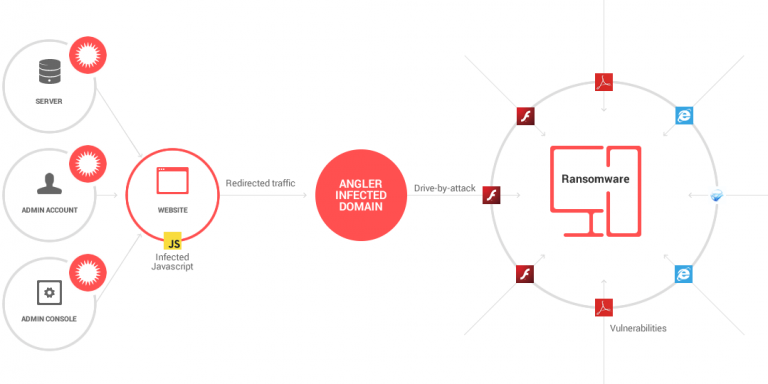

The cryptocurrency space has always been vulnerable to cyberattacks due to its decentralized and largely unregulated nature. Hacks and exit scams are two primary methods by which cybercriminals target digital assets. In a hack, attackers exploit vulnerabilities in an exchange, wallet, or smart contract to gain unauthorized access to funds. Exit scams, on the other hand, occur when a fraudulent entity raises money through an initial coin offering (ICO) or other means, only to disappear with investors’ funds.

October’s losses highlight a troubling trend: cybercriminals are becoming more adept at exploiting weak points within the cryptocurrency ecosystem. Whether through malicious code, phishing schemes, or exploiting human error, these actors can compromise even seemingly secure systems. For the digital asset space to continue growing, stronger security frameworks are essential.

Why Traditional Security Measures Are Failing

Traditional cybersecurity measures are often insufficient in the context of digital assets. Cryptocurrencies are decentralized, meaning they lack the oversight and protective infrastructure found in traditional financial institutions. Additionally, many exchanges and wallet providers are relatively young and lack the mature cybersecurity practices of more established industries.

The anonymous nature of cryptocurrency transactions further complicates security efforts. Once assets are stolen, tracking or recovering them is challenging, as funds can quickly be transferred across different wallets and platforms, often in jurisdictions with little regulatory oversight. Given these unique challenges, the cryptocurrency industry must adopt a more proactive, prevention-first approach to cybersecurity.

The Need for Proactive Cybersecurity in Cryptocurrency

With cyber threats evolving rapidly, a reactive approach to security is no longer sufficient. Instead, exchanges, wallet providers, and other entities in the cryptocurrency space must implement proactive cybersecurity strategies that focus on prevention and containment.

A Zero Trust security model is an effective strategy in this regard. Zero Trust operates on the principle of “never trust, always verify,” meaning every access request must be authenticated and authorized, regardless of its origin. This approach helps prevent unauthorized access, even if an attacker has obtained legitimate credentials.

Containment technologies are also essential for the cryptocurrency industry. By isolating suspicious code and files before they can execute, containment solutions prevent malware and other malicious software from spreading across the network. In the event of an attempted hack, containment can significantly reduce the potential for widespread damage, protecting both the platform and its users’ assets.

The Role of Regulatory Compliance

While the cryptocurrency industry remains largely unregulated, the growing frequency of attacks may soon prompt regulators to implement stricter requirements. Many countries are already discussing frameworks for cryptocurrency regulation, focusing on areas like anti-money laundering (AML) and know-your-customer (KYC) practices. Compliance with these regulations not only enhances security but also builds trust with investors who seek assurance that their assets are safe.

Cryptocurrency platforms should prepare for this shift by investing in security measures that align with regulatory best practices. Regular security assessments, penetration testing, and compliance audits can help identify and mitigate vulnerabilities, ensuring that platforms are prepared to meet any new regulatory standards that may emerge.

What Makes Xcitium Stand Out

Xcitium provides the proactive cybersecurity solutions that the cryptocurrency industry needs to safeguard against today’s sophisticated threats. Xcitium’s ZeroDwell Containment technology neutralizes threats in real time, isolating and eliminating malicious code before it can cause harm. This containment-first approach ensures that even if attackers attempt to exploit vulnerabilities, their efforts are stopped at the point of entry.

Xcitium’s platform is built on the Zero Trust model, ensuring continuous verification of every access request. This level of security is essential for cryptocurrency platforms, where unauthorized access can lead to catastrophic financial losses. By combining Zero Trust with real-time containment, Xcitium offers a comprehensive solution that addresses the unique security challenges of digital assets.

With Xcitium, cryptocurrency exchanges, wallet providers, and investors can achieve a higher level of protection, reducing the risk of losses due to hacks and scams. Xcitium’s solutions not only provide advanced security but also support regulatory compliance, positioning platforms for a future where stronger regulations may govern the digital asset space.

Conclusion: Strengthening Security in the Cryptocurrency Ecosystem

The $129 million in cryptocurrency losses from October serves as a stark reminder of the need for stronger cybersecurity in the digital asset industry. As cybercriminals become more sophisticated, a proactive, prevention-focused approach to security is essential for protecting investor assets and building trust in the cryptocurrency space.

Xcitium’s advanced containment and Zero Trust solutions offer the robust protection that cryptocurrency platforms need to defend against evolving threats. By adopting proactive cybersecurity strategies, the cryptocurrency industry can move forward confidently, knowing that it has the tools to prevent costly losses and ensure a secure future for digital assets.